The Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) have released their H2 2024 biannual review of China’s coal projects, which finds that coal is still holding strong despite skyrocketing clean energy additions in 2024.

Even as China’s clean energy surged in 2024 and became a key economic driver, solar and wind utilisation dropped sharply in Q4 2024, which was not expected or explained by weather conditions, and coal remains strong, which ultimately goes against President Xi’s 2021 pledge to phase down coal over the following five years.

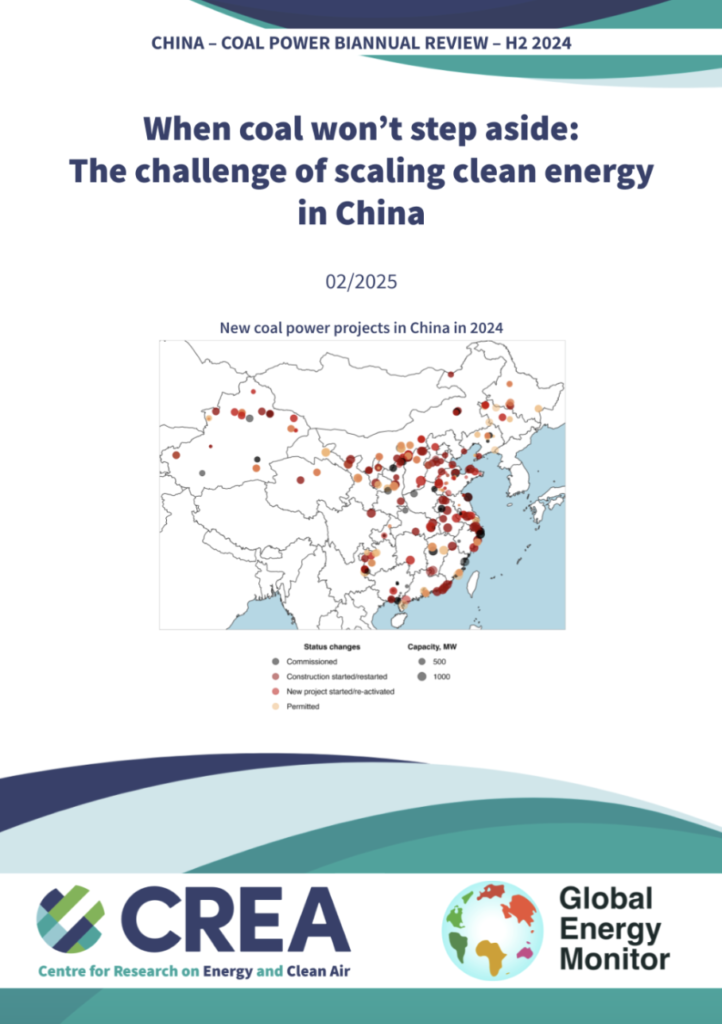

China approved 66.7 gigawatts (GW) of new coal-fired power capacity in 2024, with approvals picking up in the second half after a slower start to the year. At the same time, 94.5 GW of new coal power projects started construction and 3.3 GW of suspended projects resumed construction in 2024, the highest level since 2015, signalling a substantial number of new plants will come online in the next 2-3 years, further solidifying coal’s role in the power system.

Figure – Progress of new coal power projects and retirements in China

Note: In 2024, 66.7 GW of new coal power capacity was permitted, a decline from previous years but still above the subdued pace seen earlier in the year. New and revived coal power proposals totaled 68.9 GW, down from 117 GW in 2023 and 146 GW in 2022, indicating a potential slowdown in project initiation. Meanwhile, construction started on 94.5 GW of new coal capacity — the highest since 2015 — suggesting continued momentum in project development. However, the pace of new coal plants entering operation has been more moderate, with 30.5 GW commissioned so far in 2024, down from 49.8 GW last year but in line with 2021 and 2022 levels. Plants that both obtained permits and started construction in H2 2024 are included in both categories.

While the clean energy sector has maintained rapid growth in recent years, emerging as a key driver of economic expansion in 2023–2024, the simultaneous large-scale expansion of coal power creates a conflicting dynamic. In 2024, China added 356 GW of wind and solar capacity – 4.5 times the EU’s additions and nearly equivalent to the total installed wind and solar capacity in the U.S. by the end of the year. This record-breaking expansion highlights China’s leadership in renewables, yet instead of replacing coal, clean energy is being layered on top of an entrenched reliance on fossil fuels.

This reality makes it increasingly difficult to achieve the principle of ‘establish before breaking’ which envisions scaling up clean energy before gradually phasing down fossil fuels. Although renewable powers have been deployed at an unprecedented pace, coal power has remained firmly in place, often limiting renewables integration and full utilisation. As a result, China’s energy strategy increasingly resembles ‘energy addition’, rather than a fundamental shift toward clean energy and away from coal. This dual-track expansion raises critical questions about how effectively renewables can reshape the power system while coal power maintains its foothold.

Key findings

- Coal power permits and new project activity remain high despite some signs of slowing. In 2024, 66.7 GW of new coal power capacity was permitted – lower than previous years but still well above the levels seen in the first half of the year. Meanwhile, new and revived coal power proposals totalled 68.9 GW, down from 117 GW in 2023 and 146 GW in 2022, suggesting a potential cooling in project initiation.

- Coal power construction starts reached their highest level since 2015. 94.5 GW of new coal capacity began construction, the most since 2015, highlighting continued momentum in project development despite President Xi Jinping’s pledge in 2021 to ‘strictly control coal power projects’. However, actual commissioning has slowed, with 30.5 GW coming online so far, down from 49.8 GW last year but in line with 2021 and 2022 levels.

- China’s coal power expansion contrasts with global trends. While China continues to add new capacity, the global coal fleet outside China shrank by 9.2 GW in 2024, reinforcing China’s dominant role in shaping the future of coal power. China now accounts for 93% of global construction starts for coal power in 2024.

- Long-term coal power contracts are reinforcing coal’s dominance at the expense of renewables. Electricity buyers locked into long-term coal power contracts face penalties if they fail to purchase contracted volumes, discouraging them from prioritising clean energy. With new coal capacity coming online, guaranteed operating hours under pre-signed agreements further limit grid space for renewables, delaying the transition to a cleaner energy mix.

- Coal mining companies are playing a dominant role in financing new coal power projects. In 2024, more than 75% of newly approved coal power capacity was backed by coal mining companies or energy groups with coal mining operations, artificially driving up coal demand even when market fundamentals do not justify it. This not only reinforces reliance on coal but also risks undermining central government policy targets for curbing coal consumption and accelerating the energy transition.

- Despite policy intentions for coal power to support renewable integration, 2024 approvals show a shift away from this role, with many projects justified by local governments based on economic development and local energy security instead. While some policies promote coal power flexibility retrofits, long-term contracts and the inherent limitations of coal plants regarding low-load operation and intra-day cycling discourage coal plants from performing a true regulating function.

Policy recommendations

To prevent coal power from undermining renewable energy growth and to align China’s power sector with its carbon reduction goals, the following policy measures should be prioritised:

- Include ambitious and measurable coal consumption reduction targets, coal power phase down targets, and renewable energy expansion goals in China’s upcoming Nationally Determined Contribution to the UNFCCC and its 15th Five-Year Plan, ensuring a clear pathway toward decarbonisation.

- Reduce the share of coal power covered by long-term PPAs to prevent guaranteed coal generation from crowding out renewables in the power market.

- Lower the mandated share of coal resources allocated to long-term supply agreements and the minimum contract coverage for power generators, limiting the ability of coal mining companies to lock in demand from power plants and ensuring a more market-driven approach to coal procurement.

- Set explicit targets to reduce the average utilisation hours of coal power plants, ensuring coal power plays a supporting role rather than serving as baseload generation.

- Stop new coal power plant approvals and focus on repurposing existing plants for grid balancing to support renewable energy integration.

- Accelerate coal power retirements and cancel projects that were approved in violation of policy, reducing overcapacity and unnecessary coal investment.

- Prioritise policies and market rules for grid reform, energy storage deployment, and clean energy solutions to enhance system flexibility and support the large-scale integration of renewables.

- Expedite the development of a robust spot market to further optimise the power system and reduce reliance on coal.