Sanctions imposed by the UK and EU on Russia prohibit the importation of Russian crude oil and oil products. There is a loophole in the sanctions however that enables those countries that are not imposing sanctions on Russia (e.g., India, China and the UAE) to legally import Russian crude oil, refine it into oil products, and export those petroleum products to the UK and EU. This loophole in the sanctions enables higher sales of Russian crude oil, pushing up the selling price, and the funds sent to finance the Kremlin’s war chest.

This CREA analysis has found that since the start of the G7’s ban on the importation of Russian crude and the imposition of the oil price cap, the UK’s imports of oil products derived from Russian crude have sent EUR 165 mn in tax revenue back to the Kremlin war chest — equivalent to 28% of the humanitarian aid it has so far provided to Ukraine.

Since Russia’s invasion of Ukraine, the UK’s aid has amounted to EUR 13.27 bn, the third highest after the EU and the US. Unfortunately, the aid notwithstanding, the UK’s efforts to curb the invasion fall flat because of policies that are indirectly bolstering the Russian military budget.

Key findings

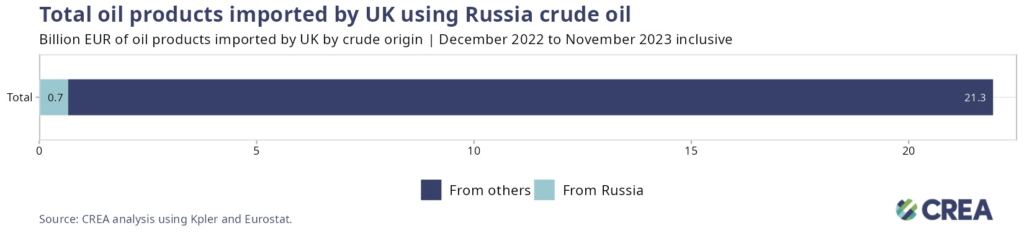

- CREA estimates that more than 3% of all petroleum products imported by the UK were produced from Russian crude oil in the 12 months since the ban was introduced. The value of these imports is approximately EUR 660 mn.

- The UK imported oil products derived from seaborne Russian crude from 12 identified refineries. 19.7% of jet fuel imported by the UK from the 12 refineries, worth EUR 510 mn, was estimated as being produced from Russian crude oil.

- In the 12 months after the EU/G7 sanctions and crude oil embargo entered into force, the UK’s imports of oil products derived from Russian crude sent EUR 165 million in tax revenues to the Kremlin, equivalent to 28% of the humanitarian aid it has so far provided to Ukraine.

Next steps

- The first and most important step for the UK would be to ban the importation of oil products produced from Russian crude oil to enhance the impact of sanctions. This ban would disincentivize third countries from importing large amounts of Russian crude — a proportion of which is turned into oil products for export to sanction imposing countries — and help cut Russian revenues. The low reliance (3%) of the UK on oil products produced from Russian crude means that if the UK banned these imports, it would have no significant inflationary pressure on domestic oil prices.

- Vessels owned or insured by G7 countries have persisted in loading Russian oil at all ports within Russia during periods when prices remain above the price cap. These occurrences serve as compelling evidence of violations against the price cap policy. The UK Office of Financial Sanctions Implementation (OFSI), must investigate UK entities and insurance firms that have provided services to facilitate the maritime transportation of Russian oil above the oil price cap. Penalties must be implemented on firms that violate sanctions and facilitate Russia to increase their oil export earnings above the price cap used to fuel the war on Ukraine. Current penalties for entities caught as violating the oil price cap are inadequate.

- The UK and Oil Price Cap Coalition should introduce a spill insurance verification program for vessels that travel through their waters. Sanctioning countries could mandate that tankers travelling through their waters must provide compliant spill liability insurance under international maritime law. This could exclude “shadow” tankers without spill insurance from travelling through their most travelled route from Baltic ports whilst reducing the risk of environmental catastrophe. If this policy excluded many “shadow” tankers from transporting oil from the Baltic ports, it could increase Russia’s reliance on legally insured vessels and increase the leverage of the oil price cap policy.

- The most important way to cut Russia’s export revenues though will be to drive down the oil price cap and use their reliance on G7/EU insurance to do so. A price cap of USD 30 per barrel would have slashed Russia’s revenues by EUR 4.9 bn or 41% in November 2023 alone. If this price cap had been established in December 2022 and paired with full enforcement, when the sanctions were originally implemented, Russia’s oil export earnings would have been reduced by 40% (EUR 56 bn). Further, lowering the price cap would be deflationary, reducing Russia’s oil export prices and inducing more production from Russia to make up for the drop in revenue.

Methodology

The complete methodology is available in the pdf of the report.

Editor’s note: The detailing of our methodology in this analysis was updated on 15 April 2024. The earlier version did not explicitly convey the methodology we had employed to derive the amount of Russian crude consumed to make products for sanctioning countries. We apologise for any inconvenience.