By Andrei Ilaş

The oil prices are a crucial variable to follow as sanctions against Russia’s unprovoked invasion of Ukraine are reviewed in the coming months. Due to Russia’s flexible and rent extracting tax structure on oil sales, high prices significantly increase Russia’s federal tax revenues. At high oil prices, the political support for tougher sanctions is at risk of diminishing due to oil prices’ effect on inflation, their recessionary effect and issues associated with the current cost of living crisis. Policymakers are aware of Russia’s role in the global supply of fossil fuels, especially oil, thus price caps have been devised with the aim of maintaining the flow of Russian oil but reducing the value extracted from these flows, dollars that ultimately fund the aggression against Ukraine. To fully grasp the extent to which price caps can be brought down to levels that would deny the Kremlin of taxable revenues, policy makers have to understand well the mechanisms that drive oil prices.

In this article I am looking at the evolution of oil prices, specifically Brent blend, the discounts observed on Ural blend and most importantly, the balance of supply and demand that drives the prices at which oil is sold on international markets. Additionally, we look at how effective price caps and EU oil imports ban are at diminishing the oil and gas tax revenues that end up in the state coffers of Russia, ultimately financing the unprovoked war against Ukraine. We share good news: oil prices are currently weighed down by high interest rates and uncertain demand growth. Meanwhile, inflows to Russia’s budget from the sale of oil and gas are decreasing as the discounts on their oil sales are getting higher due to the price caps and EU oil imports ban.

Actual oil prices challenge forecasts projecting significant increases

Brent oil prices averaged USD 101 per barrel in 2022 compared to USD 71 per barrel in 2021, a 30% increase due to the market volatility introduced by Russia’s invasion of Ukraine.

Brent oil prices have come down to pre-war levels in December 2022 and January 2023, averaging USD 81 and USD 83 per barrel respectively. In February, Brent oil average prices came close to the same value as in January 2023. There are three main variables that will impact the oil prices in 2023 through changes in the balance between demand and supply.

The first factor impacting global oil prices is the rate of monetary tightening operated by the Federal Reserve and European Central Bank (ECB) in their fight against high inflation. High interest rates reduce the demand for commodities, and consequently put downward pressure on prices as some economic activity does not happen when high interest rates are the norm. The Federal Reserve has diminished the pace of monetary tightening, raising interest rates by 0.25 percentage points (pp) on February 1st versus 0.5 percentage points in the beginning of the cycle, but inflation is still high according to the latest data which might lead to an acceleration of the monetary tightening. In Europe, the ECB is continuing the monetary tightening, raising interest rates by 0.5 percentage points in early February and vowing to keep this course until inflation returns to the medium target level of 2%. Thus, high interest rates are here to stay on both sides of the Atlantic, reducing demand and spending which offers no support to higher oil and commodities prices.

The second biggest impact on oil prices is the re-opening of China after the lockdowns on account of several COVID-19 waves. The re-opening of China will increase transport volumes and consequently the demand for oil which can put upward pressure on oil prices. China accounts for roughly 15% of global oil demand and any upwards or downwards move in its demand can impact prices significantly. The overall likely upward pressure on oil demand and prices coming from China is however subject to some uncertainties related to high debt levels and weak consumer sentiments which might not materialize into as large a demand increase as expected. China’s oil demand is dominated by freight transport and industry, rather than passenger transport where most of the space for rebound is.

Lastly, the third crucial variable is Russia and its production levels given the sanctions EU and the price cap coalition have imposed on the sale of its oil and oil products. Russia has already announced a production cut of 0.5 million barrels per day starting in March, highly likely a sign of not finding enough demand for its products under the current sanctions regime. The fact that the price caps are clearly above market clearing prices in some markets gives Russia an incentive to try and manipulate the price — an additional argument for lowering the price cap levels. Markets have reacted with mild price increases. Russia is however selling its crude at significant discounts, in a period where its public finances are stretched thin and it has little policy space for enacting deep production cuts that could flare prices. Finally, average short run marginal costs of Russian oil are significantly below even the discounted prices Russia is currently receiving for its oil, hence it is still incentivised to sell oil at discounted prices.

In terms of price outlooks, Goldman Sachs has led the chorus of oil prices being at a very high level this year, following its forecasts in the beginning of the year. Since then, the bank has already cut its projections once. Its price outlook dropped to 92 USD per barrel from 98 USD per barrel last year. Morgan Stanley holds the same views. JP Morgan started the year with a view out of sync compared to the one exposed by Goldman Sachs, seeing oil prices at around 90 USD per barrel in 2023, on average. We hold the view that under the current high interest rate regime, support for high prices is rather thin, even more so if China fails to deliver on significant demand growth. Despite the rhetoric, Russia has no policy or financial capacity to cut supplies significantly and should be selling volumes close to historical levels through deep and increasing discounts.

Source: EIA, Trading Economics

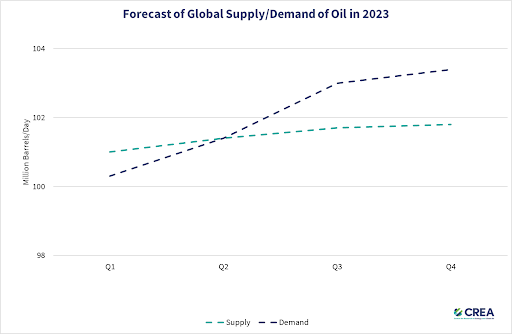

The balance of supply and demand is positive in Q1 2023 supporting a price cap lower than USD 60/barrel, as oil prices are unlikely to increase significantly this year

IEA is forecasting a 2% increase in global oil demand to 101.9 million barrels per day in 2023 compared to 2022, mostly driven by China’s reopening which accounts for an estimated 0.5 to 1 million barrels per day in increased demand. The estimated global demand is considered to be a record, 1.9 million barrels per day more than in 2019.

According to the IEA Oil Market Report, the supply balance for the first half of 2023 is positive meaning the available supply exceeds the demand which should keep prices in check. For the second half, the situation reverses as IEA expects an increase in demand and a drop in Russia’s output on the back of sanctions adopted on February 5th.

Supply is expected to grow in 2023 by 1.2 million barrels per day led by non-OPEC countries such as the United States, Brazil, Norway, Canada and Guyana increasing oil production.

The expected supply demand imbalance for the second part of 2023 is predicated on China’s demand materialising and OPEC+ maintaining its tight grip on the supply ceiling it enacted in November 2022, running through 2023. The OPEC+ ceiling will be reviewed on April 3rd while a decision on further production can be made on June 4th.

If China’s demand growth materialises and Russia maintains output at the levels announced for March, IEA expects a supply demand deficit of roughly 2 million barrels per day in Q3 and 3 million barrels per day in Q4 of this year.

While this is overall a reasonable analysis, there are two issues that remain to put downward pressure on prices. First, high interest rates that are here to stay at least for the entire 2023. OECD countries are expected to account for 46.4 million barrels per day of demand, or 46% of global demand, and most countries will live in 2023 with high interest rates which cannot support high economic output and are usually detrimental to high commodity prices. Second, China’s demand expectations are still subject to uncertainty regarding the pace of economic recovery post Covid.

Source: IEA

Russia budget revenues from taxing oil and gas extraction and sales have shrunk thanks to the price cap and embargo on Russian oil

Russia’s federal budget is highly dependent on taxes levied on exports of fossil fuels, especially on oil and gas. The Russian Federal budget was approximately 343 Billion dollars in 2021 while taxes on oil and gas extraction and sales amounted to 127 Billion dollars, the equivalent of 37% of the total budget. Taxes on oil and oil products account for 80% of total oil and gas taxes while the rest is accounted for by taxes levied on fossil gas. As shown in Figure 3, oil and gas taxes are closely correlated to the prices at which Russia can sell its fossil fuels. Russia’s budgetary vulnerability to fossil fuel revenues gives the price cap coalition strong leverage to starve Putin’s war chest by lowering the price caps on oil and oil products.

In 2022, Energy Intelligence reported Russian revenues from oil and gas taxes increased by 93% in the period January-May as compared to the same period of 2021 on the back of Brent prices averaging 104 USD per barrel, slightly higher than 101 USD per barrel for the entire year of 2022. Current estimates of the 2022 Federal budget amount to 358 Billion USD for all revenues. In 2022, the taxes from oil and gas extraction and sales accounted for a record 46% of the federal budget according to our calculations based on Bloomberg data and estimates of Russia’s federal budget for 2022.

There are two significant taxes on Russia’s oil exports: the Mineral Extraction Tax (MET) and the Export Duty (ED). For 2022, the target rate for the MET in 2022 was 18,219 RUB/t (appr. USD 37 per barrel), based on an assumed average selling price of USD 62.2/barrel, and the export duty is set at USD 5.9 per barrel. These high rates of tax demonstrate that oil production costs in Russia are very low and at current selling prices, the clear majority of sales revenue is retained by the state as tax, making funds available for financing the full-scale invasion of Ukraine.

Source: Energy Intelligence, Trading Economics

Figure 4 presents the oil and gas tax revenues to the Russian federal budget. In 2022, Russia earned USD 166 Billion from the taxes on sales of oil and gas. This accounted for 46% of the federal budget in 2022. There are two major spikes in the monthly revenues, the first immediately following the invasion of Ukraine when Brent prices averaged USD 111 per barrel and the discounts on Russian oil were just starting to occur, and the second in October when Gazprom was levied a one-off tax as its revenues soared with the increase in gas prices.

Source: Bloomberg, Trading Economics

Recent media reports on data for January 2023 reveal that the income of the federal budget from oil and gas taxes has decreased by 54% compared to December 2022 and by 46% compared to the same month of 2021. The production of oil and oil products has remained constant in January 2023, at 10.9 million barrels per day, in line with the September – November average and higher than the entire 2022 average at 10.7 million barrels per day, which includes the decline in April and May following the invasion of Ukraine.

The only variables that changed in December which could have had an effect on the revenues are the oil price cap of USD 60 per barrel imposed on December 5th by the price cap coalition and the EU embargo on Russian crude oil. Additionally, the European Union has put in place an embargo on oil products, having gone into effect in February 2023. As Russian oil production volumes have not shrunk in January, the fall in revenues is highly likely accounted for by a steepening of the discounts at which willing buyers are offtaking Russian crude and crude oil products.

The evolution of the January 2023 tax revenues from oil and gas production and sales is highly likely pointing to the oil price cap and embargo on Russian oil in Europe being very effective tools to diminish revenues of the federal budget from Russia’s mineral wealth. In this context, the announced production cut of roughly 5% of Russian production of oil in March, the equivalent of 0.5 million barrels per day, is proof of Russia not being able to find enough offtakers for its crude oil and products rather than an intention to slash production volumes to respond to the sanctions, a view exposed in the most recent IEA Oil Market Report.

In the most recent month of CREA’s data (21 Jan – 21 Feb 2023), 65% of crude oil shipments were transported by ships owned and/or insured by EU & G7 countries and 79% for oil products and chemicals. This illustrates that the price cap coalition has strong leverage to ratchet down the price cap level. Lowering the prices that Russia receives for its oil exports via the price cap, would significantly hinder Russia’s ability to fund the war, especially important as it deals with large fiscal deficits in 2023.