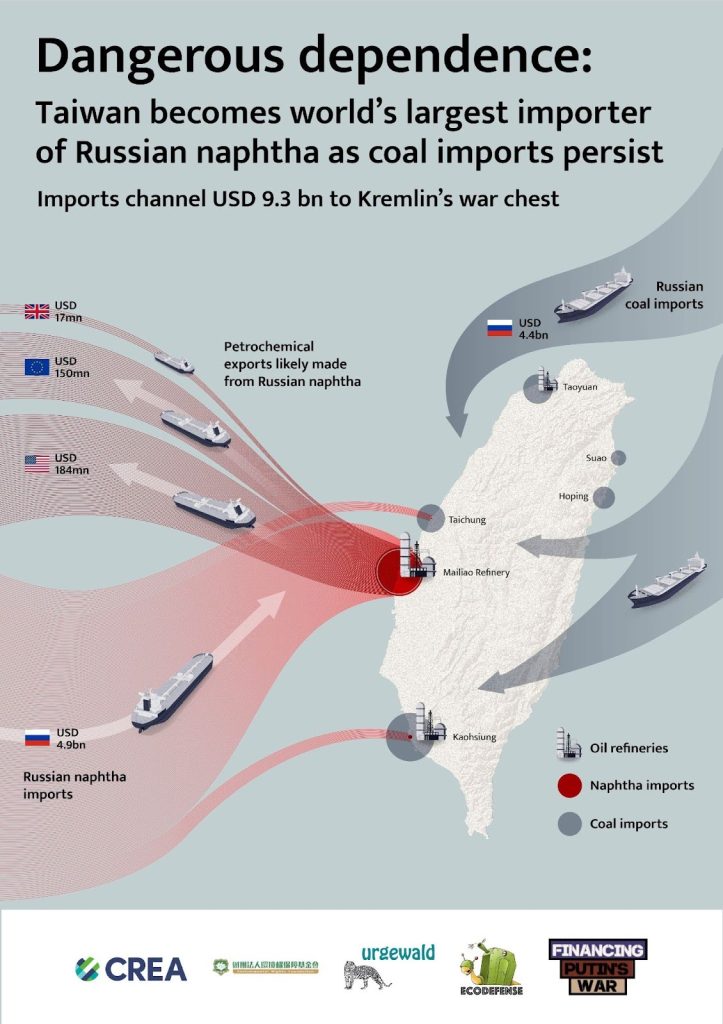

Imports channel USD 9.3 bn to the Kremlin’s war chest

*下面提供中文版本

Despite joining international economic sanctions on Russia just one day after the start of the full-scale invasion of Ukraine and restricting the sale of high-tech products that can potentially be used for military purposes, Taiwan has refrained from imposing legal restrictions on the importation of Russian fossil fuels.

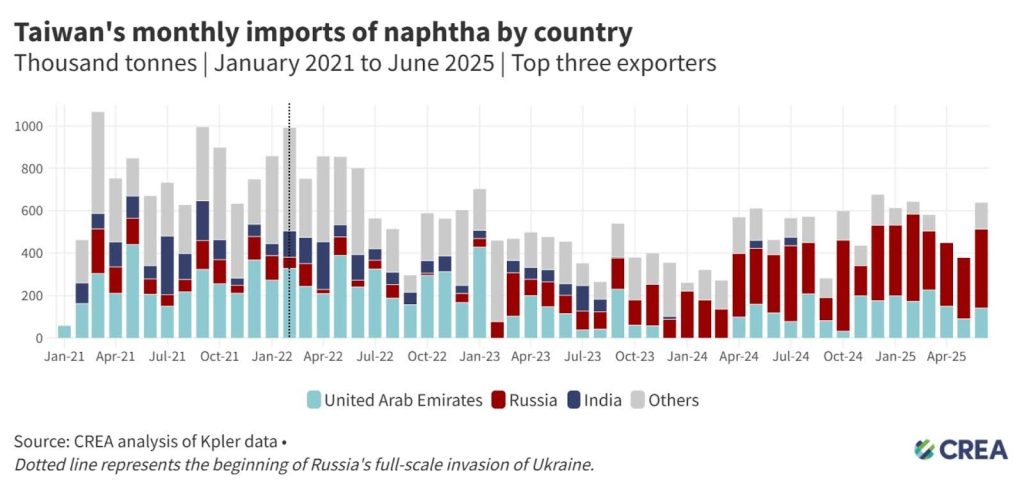

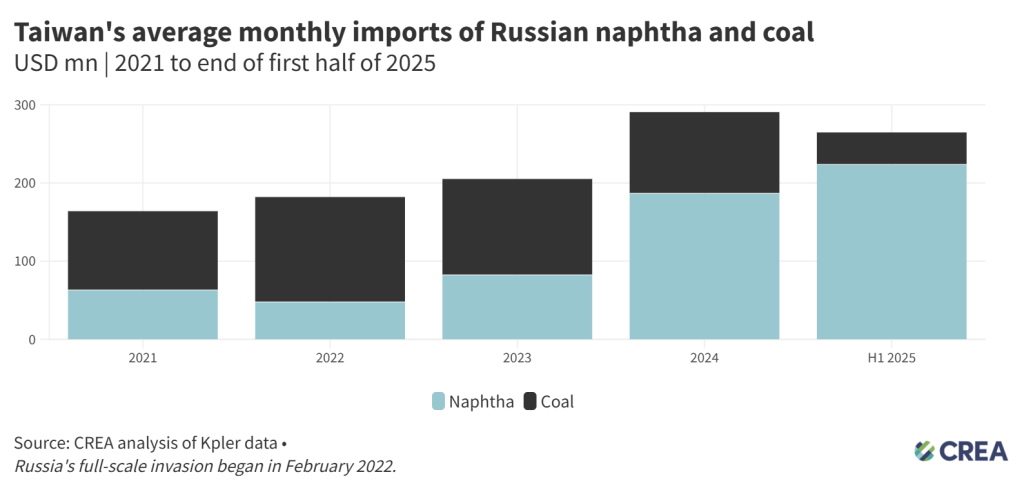

This has led to markedly different trajectories for the island’s two key Russian energy imports, coal and naphtha. While Taiwan has largely succeeded in reducing Russian coal dependence, falling 67% in the first half of 2025 compared to 2024, Taiwan’s imports of Russian naphtha – a fossil fuel derivative – have surged, making it the world’s largest buyer.

State-owned electricity company Taipower, and Taiwan Cement Corporation (TCC), the largest private buyer of Russian coal in 2023, successfully eliminated Russian coal purchases in the latter half of 2024. Similarly, state-owned Chinese Petroleum Corporation (CPC) has not received a shipment of Russian naphtha since June 2024.

Yet, other private companies have moved in the opposite direction: Formosa Petrochemical corporation (FPCC) massively increased its Russian naphtha reliance from 9% before the full-scale invasion to 90% in the first half of 2025, single-handedly making Taiwan the world’s largest buyer of Russian naphtha. Furthermore, since the start of Russia’s full-scale invasion of Ukraine until the end of June 2025, FPCC has been the single largest known buyer of Russian naphtha in the world.

Similarly, other private companies have continued to import Russian coal, spending on average USD 41 mn per month in the first half of 2025.

The continued reliance on Russian fossil fuels exposes Taiwan to significant strategic and diplomatic risks. On August 6, 2025, President Trump signed an executive order imposing secondary tariffs on India — doubling existing duties to 50% — as punishment for its continued purchases of Russian oil, with an additional 25% penalty taking effect later that month. In a similar vein, on 13 September, 2025, the US President called NATO allies’ Russian oil imports ‘shocking’ and demanded swift sanctions, once again signaling close scrutiny over Russia’s global energy exports.

Taiwan, along with other importers of Russian fossil fuels, is putting itself at risk of increased U.S. secondary tariffs due to its continued reliance on Russian fossil fuels — potentially rising above the current 20% tariff rate that Taiwan faces. Higher tariffs could have a major impact on Taiwanese exporters, as exports to the United States — Taiwan’s second-largest export market — accounted for 18% of Taiwan’s export revenues in 2023.

As evidenced by the success of TCC and Taipower in ending their imports of Russian coal, paired with CPC operating for over a year without Russian naphtha, ending dependence on fossil fuels that finance the Kremlin’s war chest is achievable. It is also essential for Taiwan’s energy security, its industries, and its diplomatic relationships with sanctioning countries.