Author: Petras Katinas

Over half Russian oil exports in July relied on G7+ tankers, but ‘shadow’ tankers continue to dominate crude oil exports

Key findings

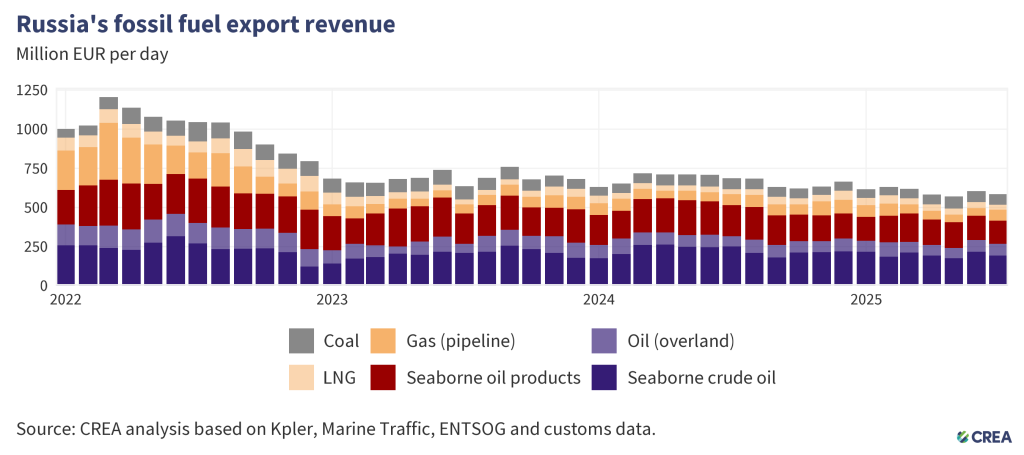

- In July, Russia’s monthly fossil fuel export revenues saw a 3% month-on-month decline to EUR 585 mn per day.

- Revenues from pipeline gas increased by 41% to EUR 71 mn per day, albeit volume increased by 33% month-on-month. The 41% rise in exports via TurkStream follows its June maintenance outage and may also reflect heatwaves boosting electricity use and gas-fired power generation.

- The five largest EU importers of Russian fossil fuels paid Russia a total of EUR 1.1 bn for fossil fuel purchases. The EU does not sanction natural gas, which accounts for over 67% of these imports. This was mainly delivered by pipeline or as liquefied natural gas in July.

- This month, Russia exported 25.3 mn tonnes of oil by sea. Over half (55%) of these oil exports were transported on G7+ owned or insured tankers, a 2% percentage point drop compared to June. Since January, the G7+ share in Russian oil transport has increased from 36% to 55%.

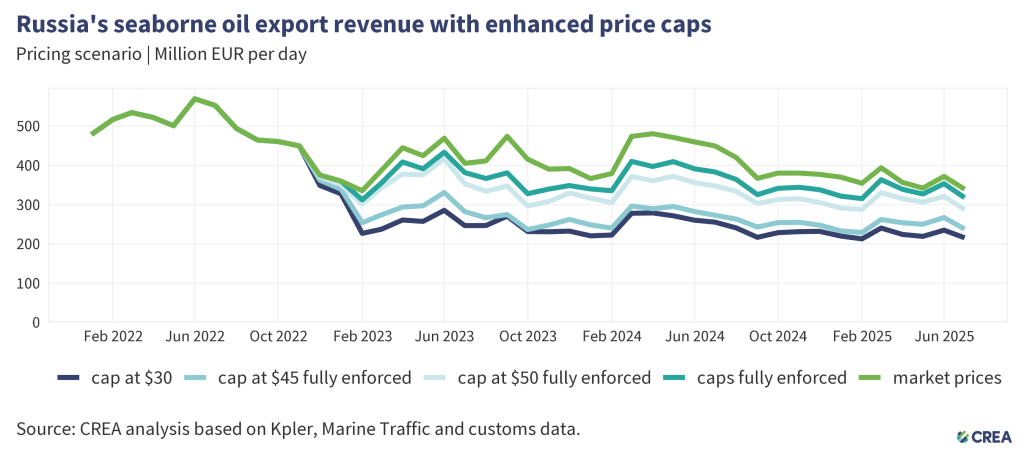

- A lower price cap of USD 30 per barrel would have slashed Russia’s oil export revenue by 40% (EUR 150 bn) from the start of the EU sanctions in December 2022 until the end of July 2025. In July alone, a USD 30 per barrel price cap would have slashed Russian revenues by 36% (EUR 3.84 bn).

- Since introducing sanctions until the end of July 2025, thorough enforcement of the price cap would have cut Russia’s export revenues by 11%. In July 2025 alone, full enforcement of the price cap would have reduced revenues by 6%.

Trends in total export revenue

- In July, Russia’s monthly fossil fuel export revenues saw a 3% month-on-month decline to EUR 585 mn per day.

- Russian revenues from seaborne crude oil saw a sharp 12% month-on-month decrease to EUR 192 mn per day, whereas volume dropped by 11%.

- Russian revenues from crude oil via pipeline marginally increased by 1% month-on-month, to EUR 75 mn per day.

- Russian liquefied natural gas (LNG) revenues dropped by 19% to EUR 30 mn per day, corresponding to a 21% drop in volumes exported. Revenues from LNG dropped for the fourth consecutive month.

- Revenues from pipeline gas increased by 41% to EUR 71 mn per day, albeit volume increased by 33% month-on-month. It could be attributed to a 41% month-on-month increase in exports via TurkStream, as the pipeline was offline in June due to annual maintenance. In addition, the increase may reflect heatwaves that raised electricity consumption and gas-fired power generation.

- Russian revenues from seaborne oil products dropped by 5% to EUR 147 mn per day, while volumes dropped by 4%.

- Russian revenues from coal saw a 2% month-on-month drop to EUR 68 mn per day, while volumes remained stable.

Who is buying Russia’s fossil fuels?

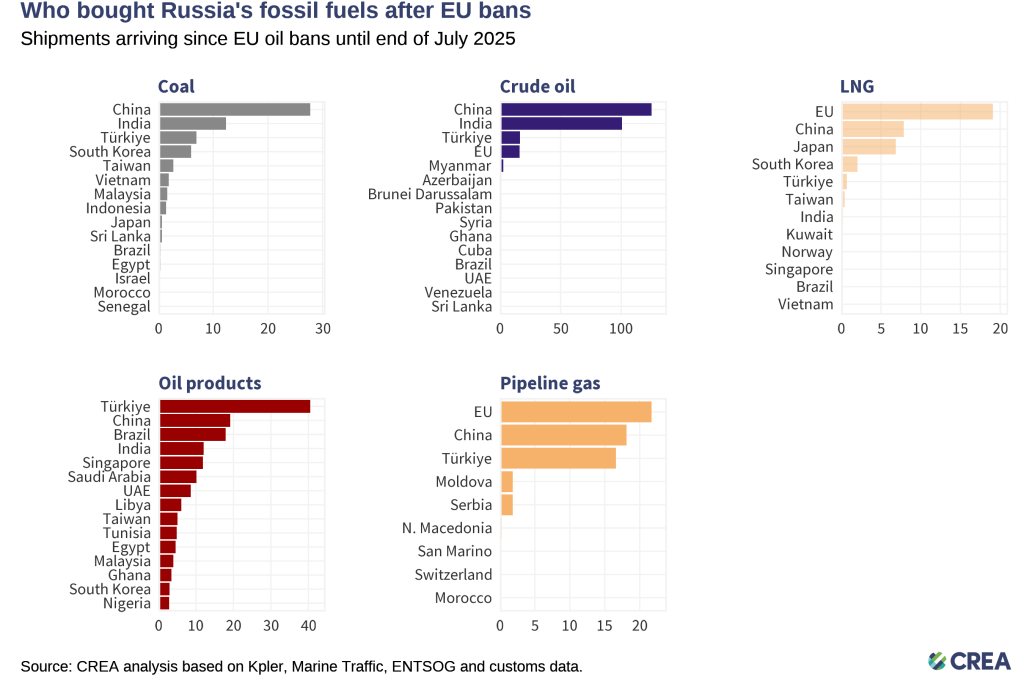

- Coal: From 5 December 2022 until the end of July 2025, China purchased 44% of all of Russia’s coal exports. India (20%), Turkiye (11%), South Korea (9%), and Taiwan (4%) round off the top five buyers list.

- Crude oil: China has bought 47% of Russia’s crude exports, followed by India (38%), the EU (6%), and Turkiye (6%).

- Oil products: Turkiye, the largest buyer, has purchased 26% of Russia’s oil product exports, followed by China (12%) and Brazil (12%).

- LNG: The EU was the largest buyer, purchasing 51% of Russia’s LNG exports, followed by China (21%) and Japan (18%).

- Pipeline gas: The EU was the largest buyer, purchasing 36% of Russia’s pipeline gas, followed by China (30%) and Turkiye (27%).

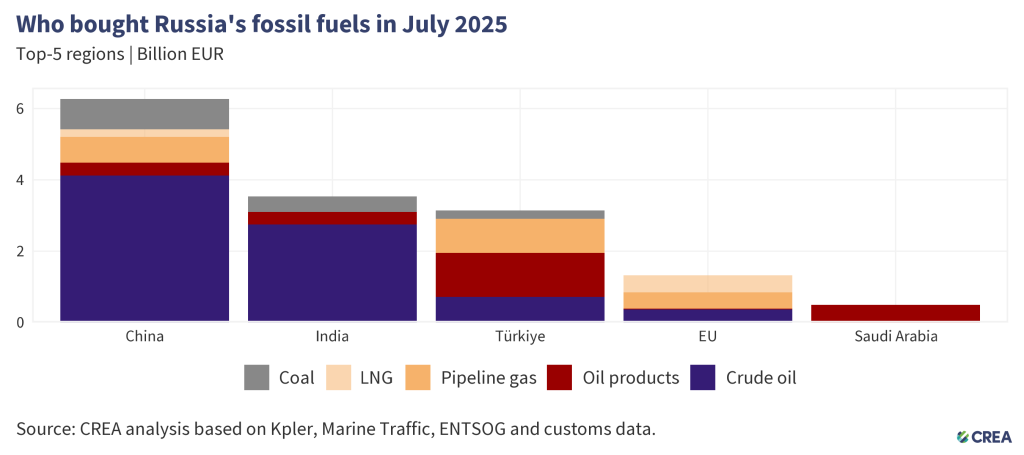

- China remained the largest global buyer of Russian fossil fuels in July 2025. Their imports accounted for 42% (EUR 6.2 bn) of Russia’s monthly export earnings from the top five importers. Crude oil comprised 66% (EUR 4.1 bn) of China’s imports from Russia.

- India remained the second-largest purchaser of Russian fossil fuels, importing fossil fuels worth EUR 3.5 bn. Crude oil accounted for 78% (EUR 2.7 bn) of these imports.

- Turkiye was the third-largest importer of Russian fossil fuels in July, contributing 21% (EUR 3.1 bn) of the total export earnings from its top five importers. Thirty-nine percent of Turkiye’s imports from Russia consisted of oil products valued at EUR 1.2 bn.

- The EU was the fourth-largest buyer of Russian fossil fuels, with its imports accounting for 9% (EUR 1.3 bn) of the top five purchasers. Seventy percent of these imports were Russian LNG and gas via pipeline, valued at EUR 930 mn.

- Saudi Arabia bought EUR 489 mn of Russian fossil fuels in July, the entirety of which were oil products.

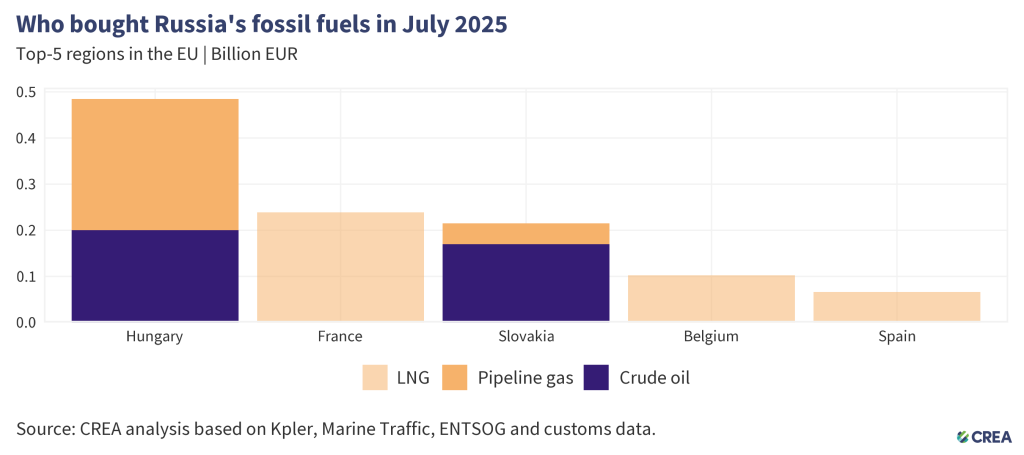

- In July 2025, the five largest EU importers of Russian fossil fuels paid a total of EUR 1.1 bn. The EU does not sanction natural gas, which accounts for over 67% of these imports and is mainly delivered by pipeline or as liquefied natural gas. The rest was mostly crude oil, which continues to flow to Hungary and Slovakia via the southern branch of the Druzhba pipeline under an EU exemption.

- Hungary was the largest EU importer in July, purchasing EUR 485 mn of Russian fossil fuels. These included crude oil (EUR 200 mn) and gas via pipeline (EUR 285 mn).

- France, the second-largest buyer within the EU, imported Russian fossil fuels worth EUR 239 mn, all of which was LNG. However, the fact that this gas is imported via France does not necessarily mean it is consumed there. A study indicates that some Russian LNG entering France through the Dunkerque terminal is delivered to Germany.

- Slovakia was the third-largest importer of Russian fossil fuels within the EU. Seventy-nine percent of Slovakia’s imports consisted of crude oil via the Druzhba, valued at EUR 169 mn. The derogation allowing Russian crude oil to be refined into oil products and re-exported to Czechia expired on June 5th.

- Belgium was the fourth-largest importer of Russian fossil fuels, with its purchases totaling EUR 102 mn. The entirety of their imports consisted of Russian LNG.

- Spain, the fifth-largest importer, exclusively imported LNG valued at EUR 66 mn from Russia.

How are oil prices changing?

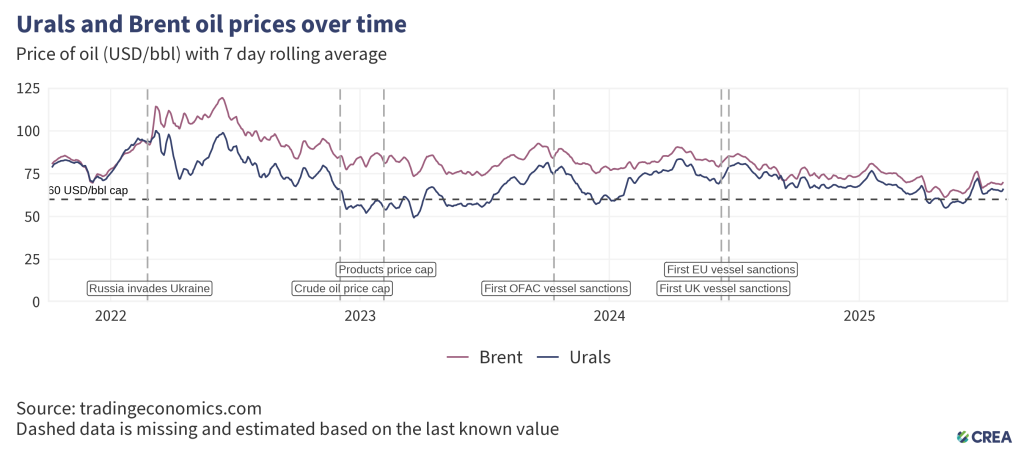

- In July 2025, the average Urals price remained unchanged at USD 65.1 per barrel.

- The movement in Russian oil prices were matched with global market movements. The benchmark Brent crude also saw a marginal 0.69% month-on-month increase in July.

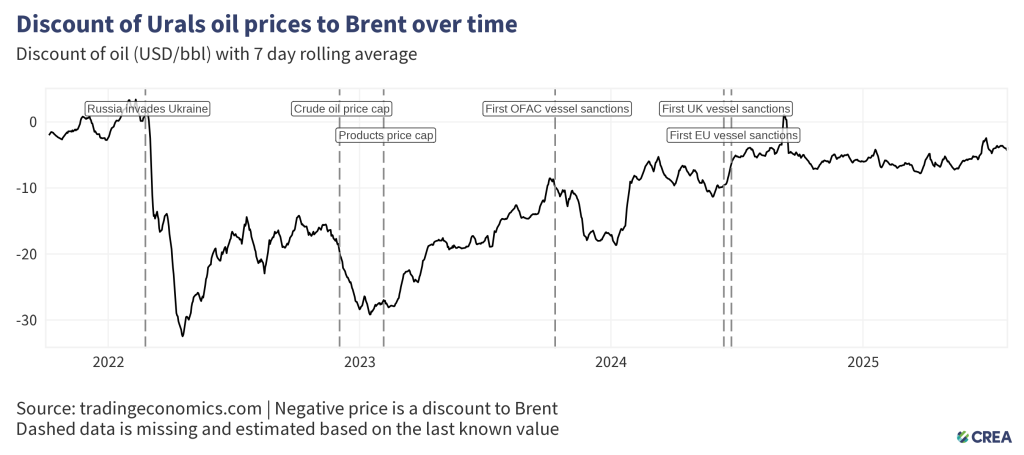

In July, the discount on Urals-grade crude oil dropped by a massive 17% month-on-month to an average of USD 3.9 per barrel compared to Brent crude oil.

G7+ tankers regaining hold on Russian oil after Western sanctions

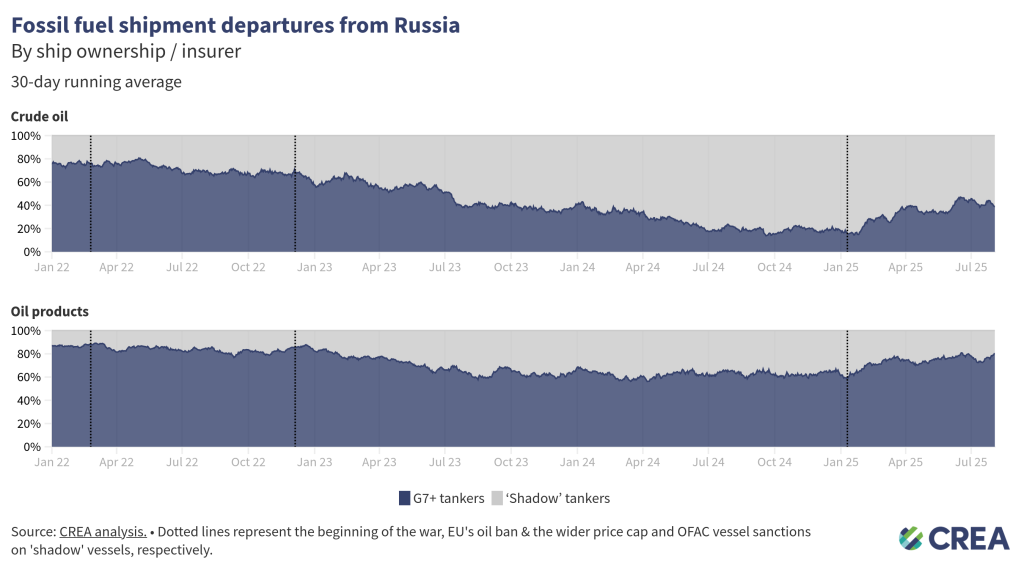

- In July 2025, Russia exported 25.3 mn tonnes of oil by sea. Over half (55%) of these oil exports were transported on G7+ tankers, a 2% percentage point drop compared to June. Since January, the G7+ share in Russian oil transport has increased from 36% to 55%.

- G7+ tankers handled 42% of crude oil shipments in July, up from just 17% in January. ‘Shadow’ tanker use for crude oil fell from 83% in January to 58% in July.

- The transport of Russian oil products has generally been less reliant on ‘shadow’ tankers. In July, G7+ tankers accounted for 75% of oil product exports, down from 78% in June.

‘Shadow’ tankers pose significant risks to ecology & impact of sanctions

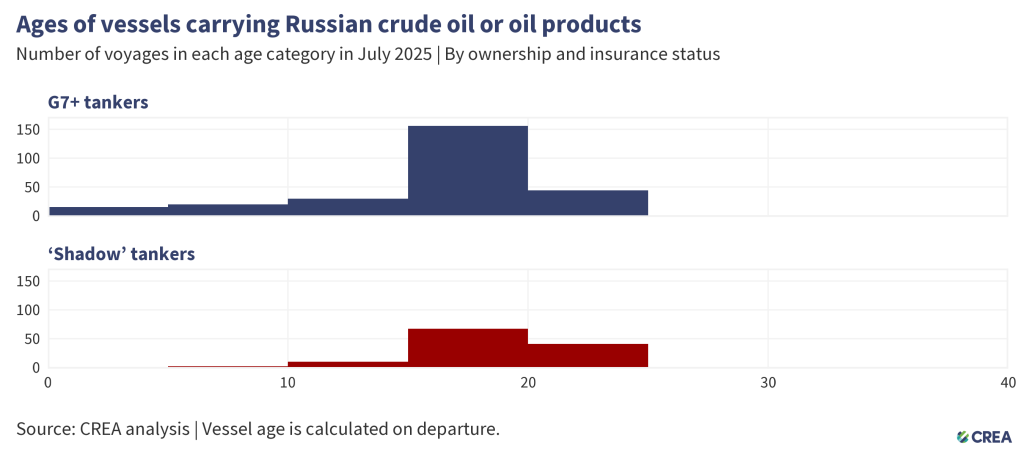

- In July 2025, 388 vessels exported Russian crude oil and oil products, of which 122 were ‘shadow’ tankers. A third of these ‘shadow’ tankers were at least 20 years or older.

- Older ‘shadow’ tankers transporting Russian oil and petroleum products across EU Member States’ exclusive economic zones, territorial waters, or maritime straits raise environmental and financial concerns due to their age, questionable maintenance records, and insurance coverage. Their insurance potentially lacks sufficient protection & indemnity (P&I) coverage to cover the cost in the event of an oil spill or other catastrophe. In the event of accidents, coastal countries may bear the financial burden of cleanup, as well as the repercussions of damage to their marine ecosystems.

- The cost of cleanup and compensation resulting from an oil spill from tankers with dubious insurance could amount to over EUR 1 bn for coastal country’s taxpayers.

Panama’s Ship Registry has stopped accepting oil tankers and bulk carriers over 15 years old. The move follows pressure over its role in registering many “shadow fleet” vessels linked to Russian and Iranian oil trades. This expands a stricter vetting process introduced in late 2024.

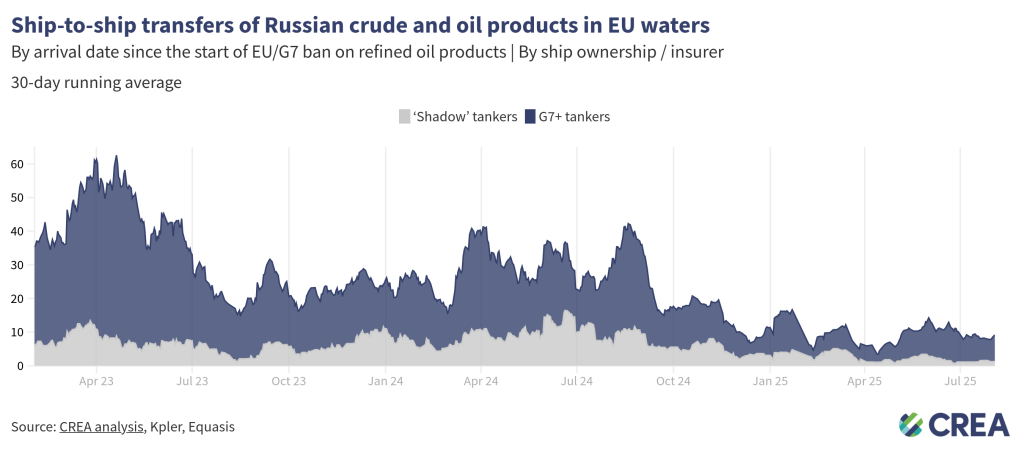

In July 2025, an estimated EUR 127 mn worth of Russian oil was transferred daily via ship-to-ship (STS) operations in EU waters — a 44 % decrease from the previous month. G7+ tankers conducted 86% of these transfers, while the rest involved ‘shadow’ vessels, which are often uninsured or registered under flags of convenience.

How can Ukraine’s allies tighten the screws?

Russia’s fossil fuel export revenues have fallen since the sanctions were implemented, subsequently constricting Putin’s ability to fund the war. However, much more should be done to limit Russia’s export earnings and constrict the funding of the Kremlin’s war chest. This includes lowering the oil price cap, increasing monitoring and enforcement of sanctions, and banning unsanctioned fossil fuels such as LNG and pipeline fuels that are legally allowed into the EU.

Lowering the oil price cap

- A lower price cap of USD 30 per barrel (still well above Russia’s production cost, which averages USD 15 per barrel) would have slashed Russia’s oil export revenue by 40% (EUR 150 bn) from the start of the EU sanctions in December 2022 until the end of July 2025. In July alone, a USD 30 per barrel price cap would have slashed Russian revenues by 36% (EUR 3.84 bn).

- Lowering the price cap would be deflationary, reducing Russia’s oil export prices and inducing more production from Russia to make up for the drop in revenue.

- Since introducing sanctions until the end of July 2025, thorough enforcement of the price cap would have cut Russia’s export revenues by 11% (EUR 40 bn). In July 2025 alone, full enforcement of the price cap would have reduced revenues by 6% (approximately EUR 0.68 bn).

Restrict the growth of ‘shadow’ tankers & tighten regulations targeting the refining loophole

- Frequent sanctioning of Russian ‘shadow’ vessels has shifted Russian oil back to tankers owned or insured in G7+ countries. Nonetheless, Russian ‘shadow’ tankers still hold sway on the transport of Russian crude oil. In addition, many sanctioned vessels continue to deliver oil to ports globally, with EU and UK sanctions in particular, frequently violated. Sanctioning countries must align their vessel lists, and enforcement paradigms for a magnified effect on their operations.

- Maritime coastal states should intensify efforts to monitor, inspect and detain ‘shadow’ fleet vessels that lack legal passage rights, such as those unflagged, unlawfully idle, or posing security risks. Authorities must enforce and improve environmental and navigation laws within their territorial waters, investigating and boarding suspicious vessels when justified. Crews involved in criminal activity should face prosecution, with noncompliant ships and personnel subject to international arrest warrants.

- In its 18th sanctions package, the EU has banned the imports of ‘oil refined from Russian crude’. The regulation bans imports from countries that are ‘net importers’ of crude oil. Net export status does not preclude the import and refining of Russian-origin crude, especially in jurisdictions with flexible or opaque crude sourcing practices. To close this enforcement gap, the exemption should be applied at the refinery level, not the national level. Refined petroleum products should be subject to import restrictions if produced at facilities that have processed Russian crude within the past six months, regardless of the final product’s declared origin or the host country’s net export position.

- The current grace period provides Russia, as well as traders buying oil refined using Russian crude with excessive time to adjust supply chains and maintain oil revenue. A shorter 60-day wind‑down period, focused on high‑risk refined products like diesel and jet fuel, would reduce Russia’s fiscal gains and limit circumvention opportunities. It would also give the EU sufficient time to secure alternative suppliers.

- The exemption of countries including the UK, USA, Canada, Norway, and Switzerland creates an opportunity for oil products refined from Russian crude to be re-exported to the EU. This gap should be closed to ensure the sanctions are comprehensive and watertight.

Stronger enforcement & monitoring of the price cap

- Despite clear evidence of violations, agencies must do more to enforce penalties against shippers, insurers, or vessel owners. This information must be shared widely in the public domain. Penalties against violating entities increase the perceived risk of being caught and serve as a deterrent.

- Penalties for violating the price cap must be significantly harsher. Current penalties include a 90-day ban on vessels from securing maritime services after violating the price cap, a mere slap on the wrist. If found guilty of violating sanctions, vessels should be fined and banned in perpetuity.

- The G7+ countries should ban STS transfers of Russian oil in G7+ waters. STS transfers undertaken by old ‘shadow’ tankers with questionable maintenance records and insurance pose environmental and financial risks to coastal states and support Russia logistically in exporting high volumes of crude oil. Coastal states should require oil tankers suspected of being ‘shadow’ tankers transporting Russian oil through their territorial waters to provide documentation showing adequate maritime insurance. Upon failing to do so, having been identified as a ‘shadow’ tanker, they should be added to the OFAC, UK, and European sanctions list. This policy could limit Russia’s ability to transport its oil on ‘shadow’ tankers, which are not required to comply with the oil price cap policy.

- To strengthen the integrity of maritime operations, it is imperative that the International Maritime Organization (IMO) revises its guidelines to enhance transparency regarding maritime insurance. The IMO should mandate that flag states require shipowners and insurers to publicly disclose key financial information, including insurer solvency data, credit ratings from recognized agencies, and audited financial statements. Maritime authorities of coastal states should be legally able and encouraged to detain tankers that fly false flags which therefore pose environmental and security threats.

Relevant reports:

- Russia’s Oil Shipments Have Quietly Slumped Over the Past Year

- Panama will not register tankers and bulk carriers older than 15 years

- Calls to close Russian oil loophole after tanker protest off Perth sparks outrage and concern

- Russia sanctions push Indian refiners to rely on traders, alternative shipping routes

| Note on methodology: This monthly report uses CREA’s fossil shipment tracker methodology. The data used for this monthly report is taken as a snapshot at the end of each month. The data provider revises and verifies data on trades and oil shipments throughout the month. We subsequently update this verified data each month to ensure accuracy. This might mean that figures for the previous month change in our updated subsequent monthly reports. For consistency, we do not amend the previous month’s report; instead, we treat the latest one as the most accurate data for revenues and volumes. Russia’s daily revenues for commodities used in this report are derived as an average, using CREA’s pricing methodology. CREA’s estimates of the impact of a revised and lowered price cap have been updated since February 2025. These numbers are a more accurate representation of the revenue losses Russia would incur. Our earlier numbers severely underestimated the impact of a lower price cap due to a bug that we identified that mislabelled commodities in our model. |